Ytd federal withholding calculator

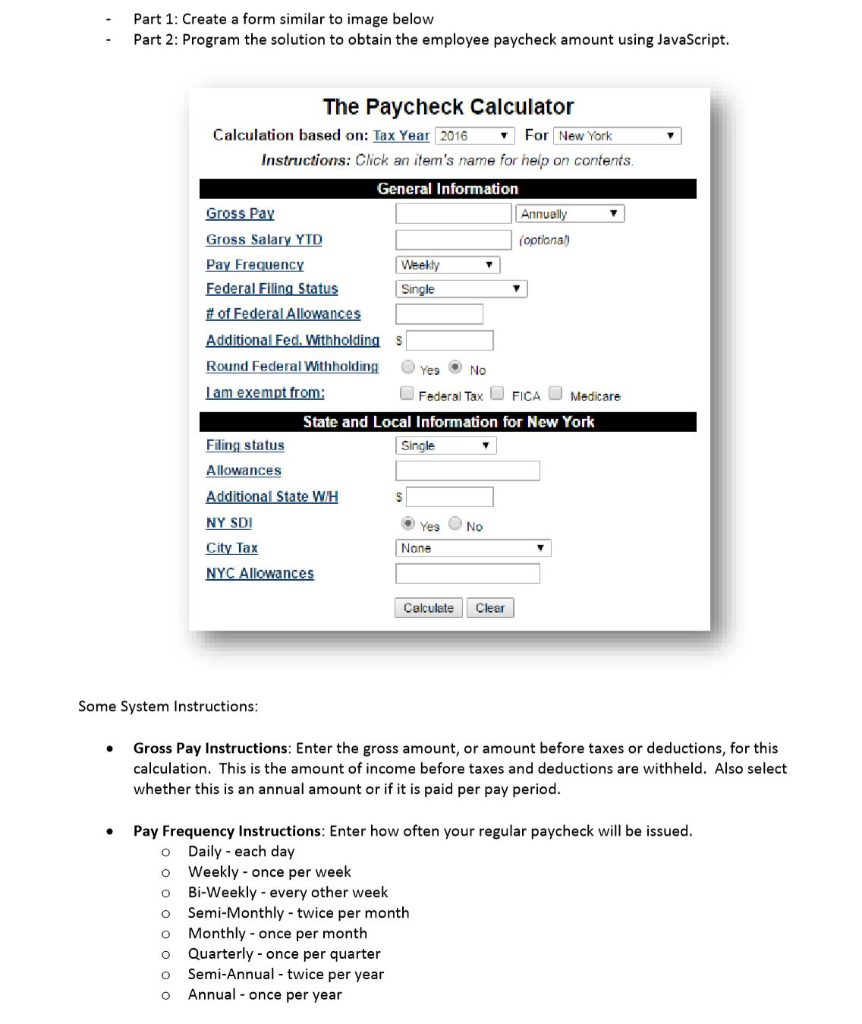

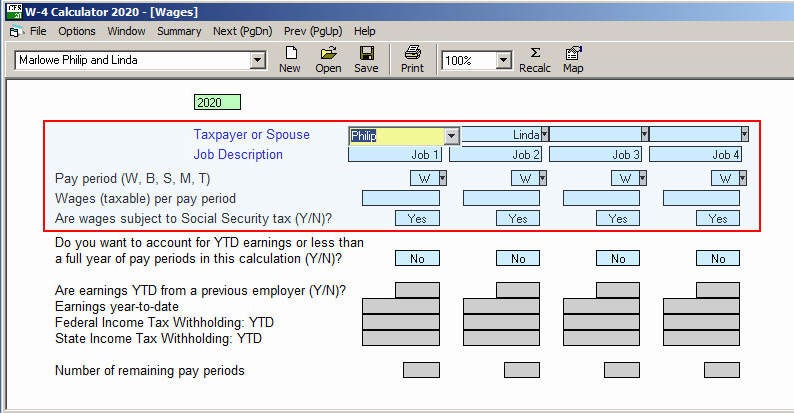

Pay Frequency Use 2020 W4. Instead you fill out Steps 2 3 and 4 Help for Sections 2 -- Extra Withholding because of Multiple Jobs If your household has only one job then just click Exit.

Ytd Calculator Calculate Your Year To Date Income

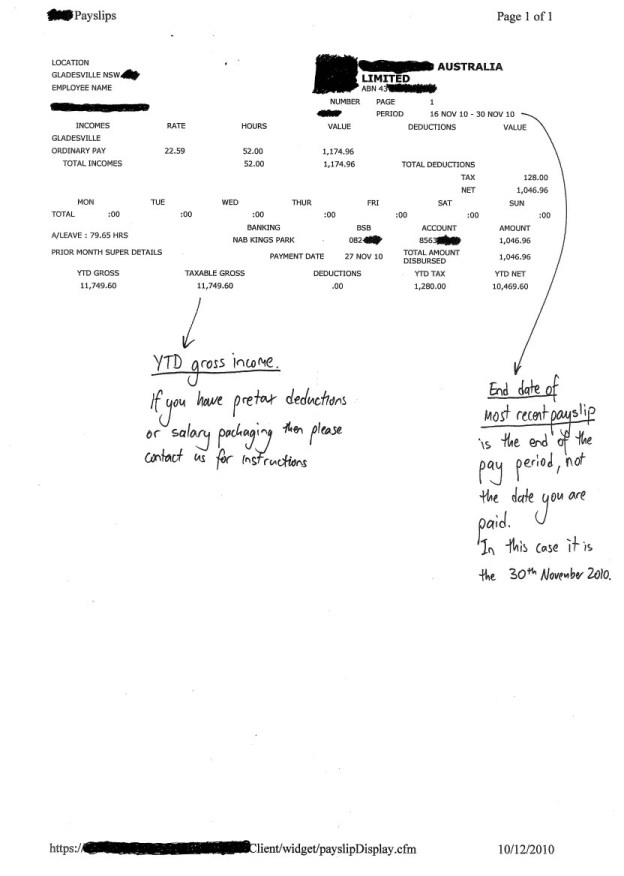

Prior YTD CP.

. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. If you have a household with two jobs and both pay about the same click. Switch to Pennsylvania salary calculator.

Switch to Texas hourly calculator. The Georgia bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. They are all using the 2020 W-4 form.

This bonus tax aggregate calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses. 401k403b plan withholding This is the percent of your gross income you put into a taxable deferred retirement account such as a 401k or 403b. State W-4 Information.

Federal Filing Status of Federal Allowances. 2022 W-4 Help for Sections 2 3 and 4. Federal Filing Status of Federal Allowances.

Switch to Missouri salary calculator. Calculate your Wisconsin net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Wisconsin paycheck calculator. View Screenshot Bonus 7 Payroll Calculator Version 200 - Beta.

This Alabama hourly paycheck calculator is perfect for those who are paid on an hourly basis. Prior YTD CP. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

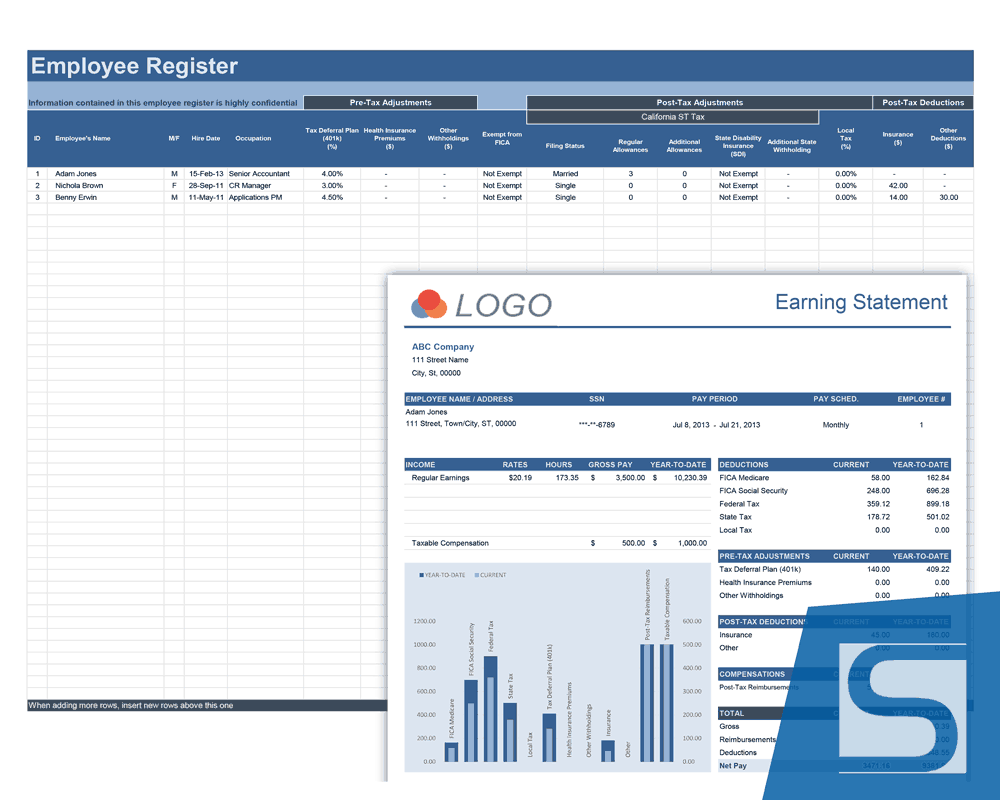

You can choose between weekly bi-weekly semi-monthly monthly quarterly semi-annual and annual pay periods and between single married or head of household. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs. Until they decide to change the math formula to look at YTD Total Gross Wages for each paycheck.

Check if you are Non-Resident Alien. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

The North Carolina bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Use PaycheckCitys dual scenario salary paycheck calculator to compare two salary paycheck scenarios and see the difference in taxes and net pay. Calculate your Arkansas net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Arkansas paycheck calculator.

The impact on your paycheck might be less than you think. While increasing your retirement account savings does lower your take home pay it also lowers your Federal income tax withholding. Free Federal and Missouri Paycheck Withholding Calculator.

This Pennsylvania hourly paycheck calculator is perfect for those who are paid on an hourly basis. Federal Filing Status of Federal Allowances. The new and completely redesigned version of the Payroll Calculator offers a degree of automation Macros Enabled Version only.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Federal Filing Status of Federal Allowances. This Ohio hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Switch to Wisconsin hourly calculator. The federal withholding taxes are not calculating for some of our employees. The Beta release includes two files.

Switch to Oklahoma salary calculator. If you have a household with two jobs and both pay about the same click. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after deductions and federal state and local income tax withholding. Medicare Tax 0. Federal Income Tax Withheld.

Switch to Missouri hourly calculator. But the default withholding rate can. Instead you fill out Steps 2 3 and 4 Help for Sections 2 -- Extra Withholding because of Multiple Jobs If your household has only one job then just click Exit.

This Missouri hourly paycheck calculator is perfect for those who are paid on an hourly basis. Exemption from Withholding. This is state-by state compliant for those states that allow the aggregate method or percent method of bonus calculations.

2022 W-4 Help for Sections 2 3 and 4. 0 Cheer Reply Join the conversation. Many federal employees believe there is an early withdrawal penalty for taking anything out of the TSP before reaching age 59 ½ but this isnt true.

This Oklahoma hourly paycheck calculator is perfect for those who are paid on an hourly basis. Switch to Arkansas hourly calculator. Total Non-Tax Deductions.

This Idaho hourly paycheck calculator is perfect for those who are paid on an hourly basis. Free Federal and New York Paycheck Withholding Calculator. Pay Stubs and Year to Date YTD include all necessary information.

Switch to North Carolina hourly calculator. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. Switch to Alabama salary calculator.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. Health Insurance POP etc SalariedAmount.

Switch to Nevada hourly calculator. This tech very helpful and had me download the IRS calculator excel worksheet. Exempt from Federal.

Payroll Calculator Free Employee Payroll Template For Excel

Ytd Calculator Calculate Your Year To Date Income

Payroll Taxes Aren T Being Calculated Using Ira Deduction

Sap Hcm Us Payroll Tax Calculation Illustration Sap Blogs

Payroll Calculator Free Employee Payroll Template For Excel

Decoding Your Paystub In 2022 Entertainment Partners

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Hrpaych Yeartodate Payroll Services Washington State University

Excel Business Math 34 Median Function For Fica Social Security Medicare Payroll Deductions Youtube

Filing Status Instructions Select Your Filing Chegg Com

W 4 Calculator Cfs Tax Software Inc

Paycheck Calculator Online For Per Pay Period Create W 4

How Do You Get Info Back On Pay Stubs Withholding Status And Allowances Extras No Longer Show On Paystub

What If Quickbooks Payroll Taxes Are Not Computing Insightfulaccountant Com

Paycheck Calculator Apo Bookkeeping

How To Read Your Pay Stub Asap Help Center

Payroll Calculator Free Employee Payroll Template For Excel